Estate Planning:

What is it and why do we do it?

You spend your entire life creating wealth. The more wealth you create the more unhappy the people you leave behind will be without the proper estate planning. Estate planning allows you to decide while you are alive how your assets will be distributed. It also allows you to protect your heirs from unanticipated devastating expenses ranging from debts to taxes to administrative fees.

Retirement Planning

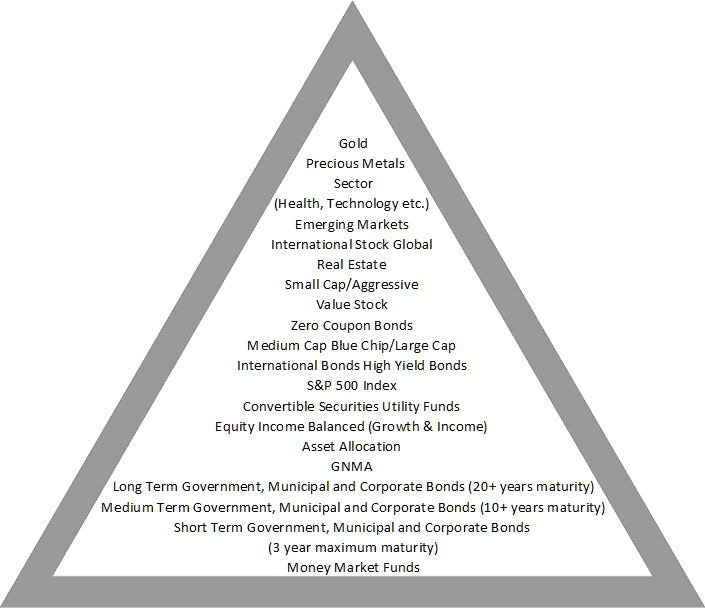

When planning for retirement you should fully fund the tax-deductible and tax-deferred savings plans that are available to you as an individual and through your employer. First on the list should be plans where the employer makes contributions and/or matches your contributions. Next should be any IRA’s that you qualify for. As you climb the investment pyramid, it becomes increasingly important to seek help from an expert.

High Risk

|

Low Risk

Investment Pyramid

A Mutual Fund

is a company that combines the investment funds of many people with similar investment goals and invests the funds for these people in a wide variety of securities. The individual receives shares of stock in the mutual fund and through the mutual fund are able to enjoy much wider investment diversity than they could otherwise receive. Each shareholder, in effect, owns a part of a diversified portfolio that has been acquired with the pooled money. As the securities held by the fund move up or down in price, the market value of the mutual fund shares moves accordingly. When dividend and interest payments are received by the fund, they are passed on to the mutual fund shareholders and distributed on the basis of prorated ownership.